World Quant

Bonus!

Concept Learning

Alpha: In quantitative finance, “alpha” usually refers to excess returns, i.e., additional returns relative to a market benchmark.

Fast Expression Language: The program language used in WorldQuant compitetion. Different from normal language which need to write everything by hand, FEL has a lot of packaged data base and functions, so it is very convenient to use it to write an alpha. Basically, a factor only requires one line of code.This makes the entry barrier for this competition lower.

Sharp: Sharpe Ratio (SR) is a measure of the relationship between portfolio return and risk. The Sharpe Ratio measures the excess return per unit of risk. The higher the Sharpe Ratio, the higher the return the portfolio would have earned had it taken the same amount of risk; conversely, the lower the Sharpe Ratio, the lower the risk-adjusted return of the portfolio. Typically, a Sharpe ratio greater than 1 is considered a good portfolio, greater than 2 is considered excellent, and less than 1 may indicate higher risk and insufficient returns to compensate for the risk

Turnover: “Turnover” can be used to measure the liquidity and activity of an asset. In general, the higher the trading volume, the more liquid the asset is and the easier it is for market participants to buy or sell the asset.

Fitness:

$$

Fitness =\frac{Sharpe \times \sqrt{|Returns|} } {\max(Turnover,0.125))}

$$

So, to improve Fitness, increase Returns and Sharpe and reduce Turnover.

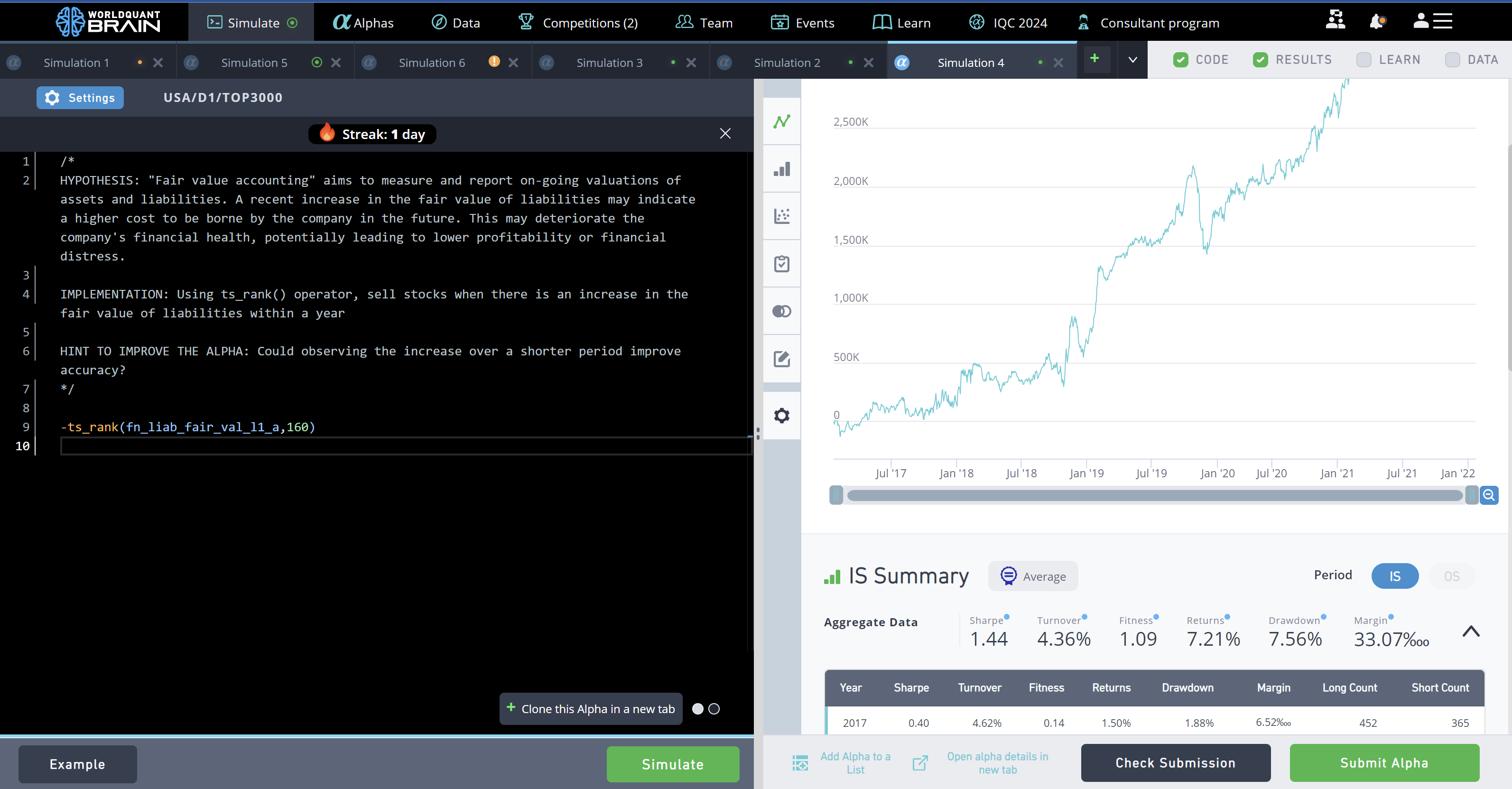

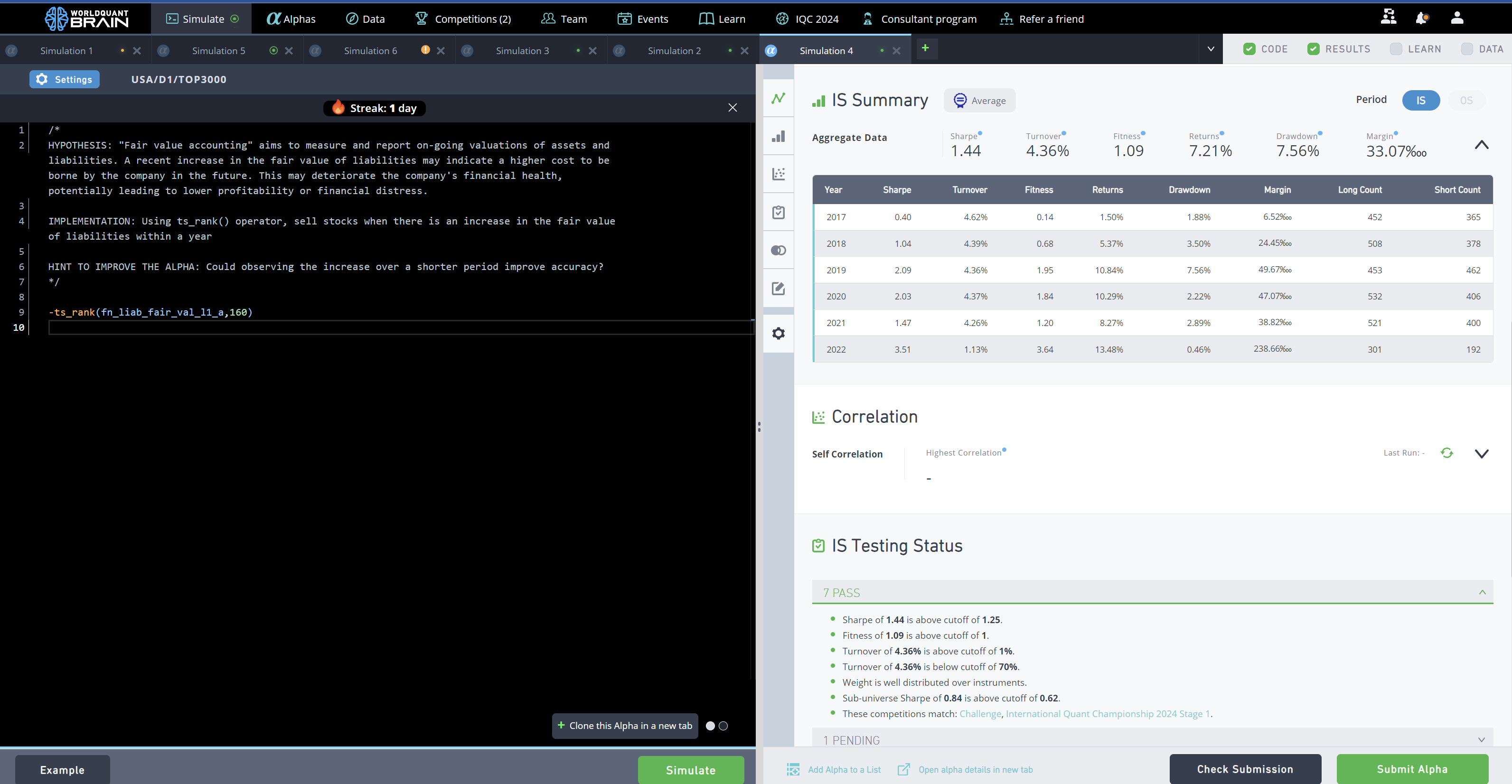

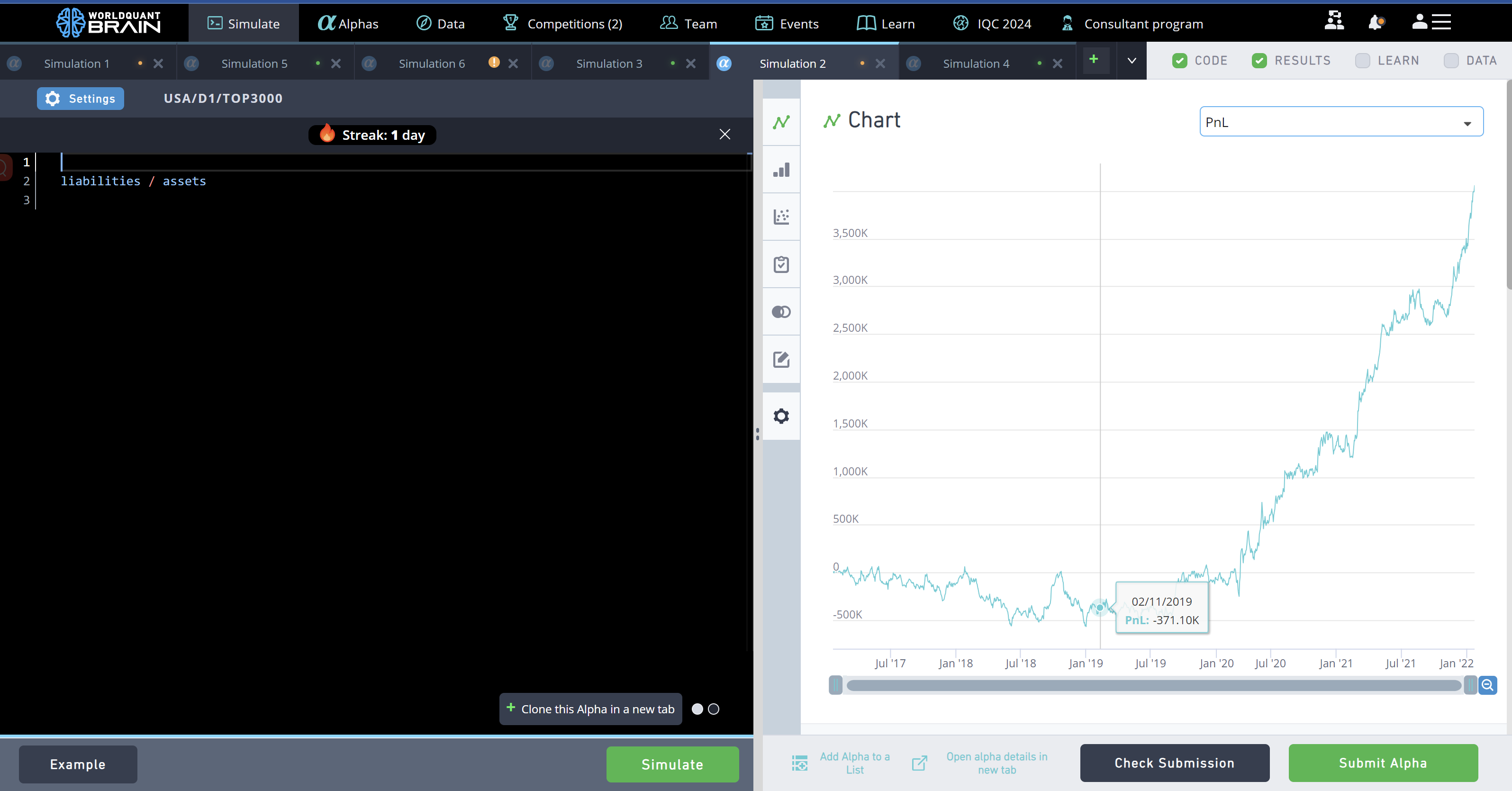

Alpha NO.1: Fair value accounting

“Fair value accounting” aims to measure and report on-going valuations of assets and liabilities. A recent increase in the fair value of liabilities may indicate a higher cost to be borne by the company in the future. This may deteriorate the company’s financial health, potentially leading to lower profitability or financial distress.

So put a minus sign in front of the rankings.

The time period is an important parameter, and after my adjustments, this factor performs best at 160 days.

Code

1 | -ts_rank(fn_liab_fair_val_l1_a,160) |

Screenshot

Comment

Sharpe rate and Fitness for this factor are both performing well to average.

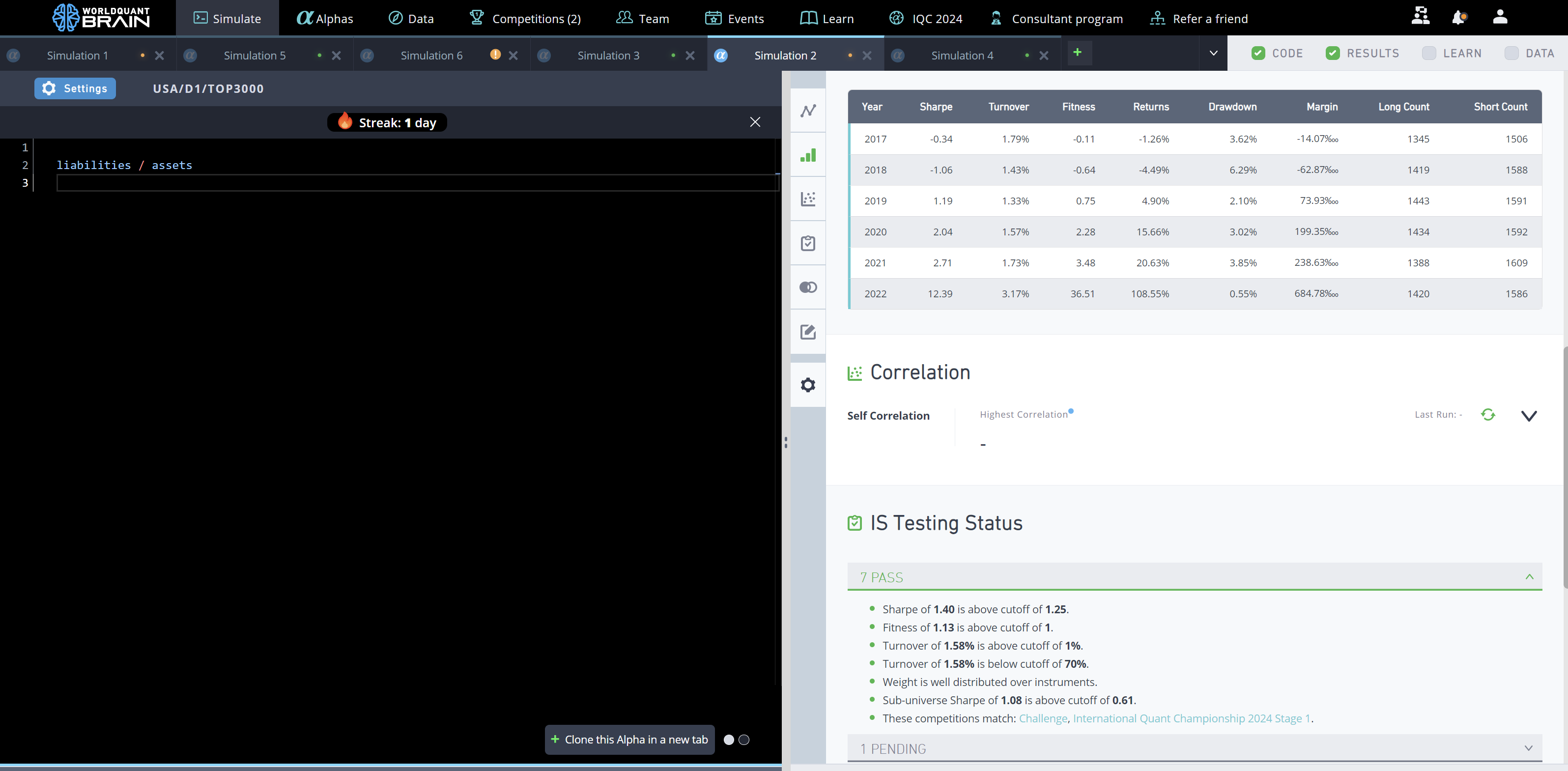

Alpha NO.2: liabilities

Comparatively higher liabilities may indicate that the company has higher leverage and may have higher returns in the future.

But too much liabilities will cause huge risk.

A ratio analysis comparison by normalizing the liability with company assets is a good alpha.

1 | liabilities / assets |

Screenshot

Thinking

It is a good way to calculate a radio between two indicators, which combine two factors leading to a better investment.

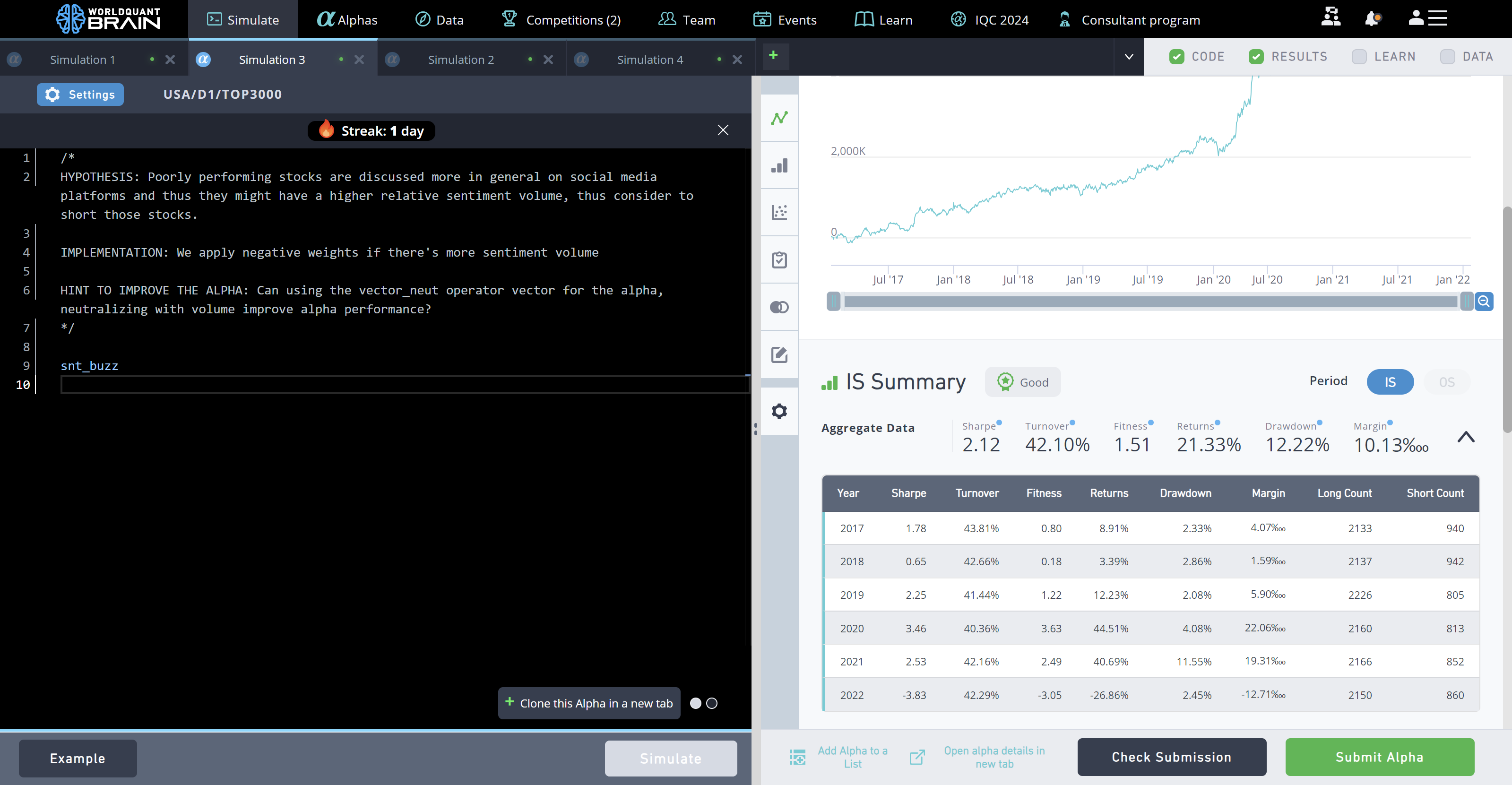

Alpha No.3: buzz

Poorly performing stocks are discussed more in general on social media platforms and thus they might have a higher relative sentiment volume, thus consider to short those stocks.

1 | snt_buzz |

Comment

This is an alpha with a rating of GOOD, the best performing alpha I have here, showing that social media data is now an important indicator for investing as well.